Table Of Content

With an adjustable-rate mortgage, the interest rate is only fixed for a certain amount of time (commonly five, seven or 10 years), after which the rate adjusts annually based on the market’s current interest rate. Fixed-rate mortgages offer more stability and are a better option if you plan to live in a home in the long term, but adjustable-rate mortgages may offer lower interest rates upfront. Depending on your credit qualifications and if you’re willing to get quotes from multiple lenders, you may be able to negotiate for a lower mortgage rate. Buying mortgage points is another way to get a lower rate if your lender provides this option. You may be able to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500.

Compare our picks for the best mortgage lenders

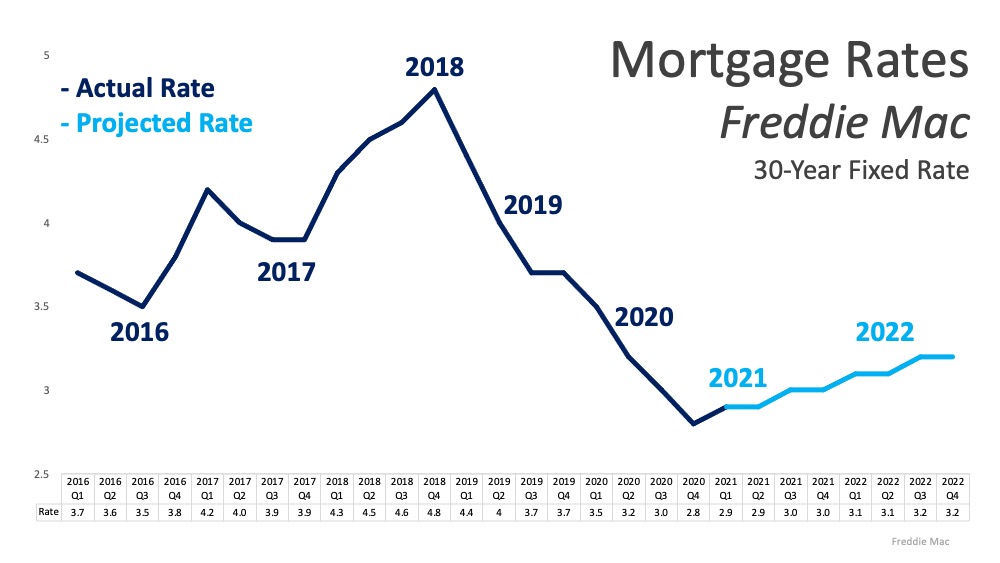

There are many ways to search for the best mortgage lenders, including through your own bank, a mortgage broker or shopping online. To help you with your search, here are Forbes Advisor’s picks of the best mortgage lenders across the country. Currently, the average 30-year, fixed-rate mortgage is 7.17% as of April 25, according to Freddie Mac. The highest interest rates in recent history were seen in the early 1980s when the Fed hiked the federal funds rate to over 19%. That was in response to record-breaking inflation that had prices rising at a rate of over 14% annually.

year fixed-rate mortgages

How are mortgage rates determined? - CNN Underscored

How are mortgage rates determined?.

Posted: Fri, 26 Jan 2024 08:00:00 GMT [source]

Compare your credit score, debt-to-income ratio and loan amount to the ones we used by selecting the View Legal Disclosures link under where rates are displayed. If you want to uncover more about the best mortgage lenders for low rates and fees, our experts have created a shortlist of the top mortgage companies. Some of our experts have even used these lenders themselves to cut their costs.

What are APR and points?

Will Mortgage Rates Go Down in 2024? What Homebuyers Should Expect - Business Insider

Will Mortgage Rates Go Down in 2024? What Homebuyers Should Expect.

Posted: Wed, 27 Mar 2024 07:00:00 GMT [source]

A quick way to determine if you should refinance is to estimate your out-of-pocket cost to refinance and divide by your monthly payment savings -- how much your payment goes down due to the refinance. The answer will represent the number of months it will take to get your money back from refinancing, also called the breakeven point. Therefore, if you plan to live in your home longer than the answer to this math problem, you should refinance.

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. If you're already working with a real estate agent, they'll likely have lender recommendations. In areas where homes get lots of offers and sell fast, your lender's reputation can affect whether your offer is accepted.

For the week of April 26th, top offers on Bankrate are X% lower than the national average.On a $340, year loan, this translates to $XXX in annual savings. Greg McBride, CFA, is the Chief Financial Analyst for Bankrate.com, leading a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience. The most important task for a prospective homeowner seeking a preapproval letter is to gather all the financial paperwork needed to give the lender a solid picture of your income, debts and credit history. This information helps underwriters estimate how much of a loan you can afford and the costs of the loan.

For mortgage pre-approval, the lender reviews your credit history and financial situation and verifies your income. Pre-approvals aren't always a firm commitment to lend, but generally, if nothing in your financial situation or credit history changes, there's a good chance you'll get a green light when you apply. These are the eight factors that can help you get the best current mortgage rate. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

How to get the best current mortgage rate

Lenders call it “risk-based pricing.” A higher credit score indicates a lower risk that you’ll default on a loan — so you get a better interest rate. She adds that if the inflation rate holds at 2%, then we should see mortgage rates remain at lower levels for the balance of the next five years. The average cost of a 15-year, fixed-rate mortgage has also surged to 6.55%, compared to 2.43% in January 2022.

Use a mortgage calculator to figure out how changing interest rates might affect you. First, your FICO® Score isn't affected by any mortgage inquiries made in the past 30 days. If you find a loan within those 30 days, rate shopping won't affect you at all. That's because of economic factors like the unemployment rate and number of recent foreclosures. The Federal Reserve has shown signs that it’s unlikely to raise rates again soon, and investors and market watchers are waiting expectantly for the first cut of 2024.

To help you find the right one for your needs, use this tool to compare lenders based on a variety of factors. Bankrate has reviewed and partners with these lenders, and the two lenders shown first have the highest combined Bankrate Score and customer ratings. You can use the drop downs to explore beyond these lenders and find the best option for you. While we adhere to strict editorial integrity, this post may contain references to products from our partners.

No comments:

Post a Comment